In the world of business, financial documents play a vital role in tracking and managing the financial health of an organization. These documents provide a clear picture of the company’s financial performance, enable accurate decision-making, and ensure compliance with legal and regulatory requirements. In this article, we will explore the crucial financial documents that every organization should maintain, highlighting their importance and key components.

Income Statement (Profit and Loss Statement)

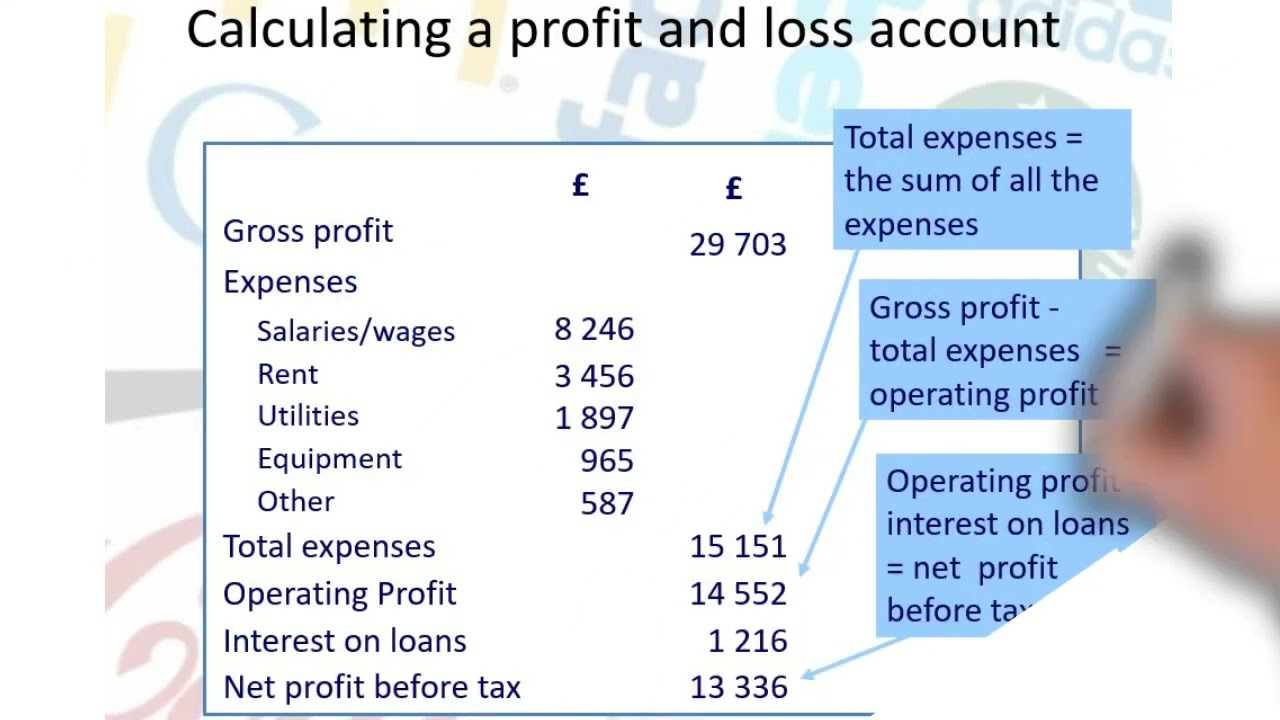

The income statement is a fundamental financial document that summarizes the revenue, expenses, and net income of an organization over a specific period. It provides valuable insights into the company’s profitability and overall financial performance. Key components of an income statement include revenue from sales, cost of goods sold, operating expenses, and taxes. This document helps stakeholders analyze the profitability and efficiency of the organization. Create pay stubs for Rhode Island here and deal with your financial documents easily.

Balance Sheet

The balance sheet is a snapshot of an organization’s financial position at a given point in time. It presents the company’s assets, liabilities, and shareholders’ equity. The balance sheet provides a clear picture of the company’s financial stability and its ability to meet its short-term and long-term obligations. It includes assets such as cash, accounts receivable, inventory, liabilities such as accounts payable, loans, and shareholders’ equity. By examining the balance sheet, investors and creditors can assess the organization’s financial health and make informed decisions.

Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash within an organization over a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities. This document helps stakeholders understand how effectively the organization generates and utilizes its cash resources. It also provides insights into the organization’s ability to fund its operations, invest in assets, and pay dividends or debts.

Financial Statements Notes

Financial statement notes accompany the core financial documents and provide additional information and explanations. They offer details about accounting policies, significant events, contingent liabilities, and other relevant information that may impact the interpretation of the financial statements. The financial statement notes ensure transparency and help users understand the context and assumptions underlying the presented financial information.

Audit Reports

Audit reports are essential financial documents prepared by independent auditors who examine and verify the accuracy and fairness of an organization’s financial statements. These reports provide an external assessment of the organization’s financial position and operations. They enhance the credibility of the financial statements and provide assurance to stakeholders about the reliability of the information presented.

Budgets and Forecasts

Budgets and forecasts are forward-looking financial documents that outline the organization’s expected financial performance and resource allocation for a specific period. They help in planning and setting financial goals, facilitating decision-making and resource allocation. Budgets and forecasts serve as benchmarks to measure actual performance against planned targets and enable organizations to make adjustments as necessary.

Tax Returns and Supporting Documents

Tax returns and supporting documents are crucial financial documents that organizations must prepare and submit to comply with tax laws and regulations. They provide an accurate record of the company’s income, expenses, deductions, and credits, ensuring compliance with tax obligations. These documents play a vital role during tax audits and help organizations avoid penalties and legal issues related to taxation.

In conclusion, maintaining crucial financial documents is essential for every organization. Income statements, balance sheets, cash flow statements, financial statement notes, audit reports, budgets, tax returns, and supporting documents provide critical information about an organization’s financial performance, position, and compliance. These documents aid in decision-making, facilitate stakeholder analysis, ensure transparency, and support legal and regulatory compliance. Organizations should establish robust systems and processes to create, organize, and retain these financial documents accurately and securely.